Good morning! Thanks for joining us here in the garden for Groundhog Day. For those of you not from the states, we have this bizarre tradition that plays out every February 2nd.

What Is Groundhog Day?

All across the country, people are un-caging groundhogs (while wearing protective gloves). Each one has its own, unique name. Here, in Pennsylvania, ours is Punxsutawney Phil.

The groundhog handlers set these little guys on the ground. If Phil sees his shadow, that means six more weeks of Winter. If he doesn’t we’ll have an early spring. Basically, we rest our meteorological future on the shoulders of a large, very crabby rodent. He did see his shadow, by the way. Punk.

Anyway, the other Groundhog Day that you may or may not be familiar with is the movie, starring Bill Murray. In the film, Murray travels to PA to cover the event, only to wake up the following day to discover he’s living the same day over again.

That brings us to the point of our post today. How many of you feel like you’re reliving your own financial Groundhog Day with every paycheck?

What a Financial Groundhog Day Looks Like

Here’s the scenario. You:

- Get paid.

- Pay your bills.

- Log other expenses.

- Then get sick, have a flat tire, or the worst….you forget about a bill all together.

Checkbook Balancing Has Changed

When I was growing up, my Mom showed me how to balance the checkbook every month. She kept a stack of bills that needed paid right beside her checkbook. When the bills came in she paid them. Everything else she paid with cash. When the cash ran out, she had no more money to spend.

But here’s the thing. She balanced her checkbook every month. Can you imagine?

It worked well for her, but one relatively new technology has blown that approach out of the water. Debit Cards. We might as well at other culprits to this list, like Auto Pay and Paypal.

My point is, that everything happens so quickly, that waiting a month to balance your checkbook could equal financial disaster.

Financial Apps

There are a host of solutions available for mobile devices that let you balance your checkbook. We’ve probably tried them all and maybe you have, too. Here’s one thing I’ve learned about them—about forming any long-term habits, really—if it’s too complicated, I won’t do it.

Here have been some of my financial app showstoppers:

- Over-complicated Apps. Many of the tools out there require an immense setup and time commitment. Even many of the tools that sync to your bank require you to edit line items. Also, adding new charges takes too much time.

- No future-planning. There’s not always a future-planning feature. Let’s say you’ve got a doctor’s appointment next month that requires a co-pay. The app doesn’t have an option to plan for that next month.

- No visibility. We’ve always done best with solutions that allow us to see into the past and into the future. Many apps only allow you to view your expenses one week at a time.

- Fees. Finally, the kicker is fees. You can have all of these awesome features, but in order to get them you have to pay a monthly fee. Which means you have to pay money to keep your financial life in order.

No, thanks. What we needed was a solution that didn’t have a claim on some of the money we were trying to save.

Our Checkbook

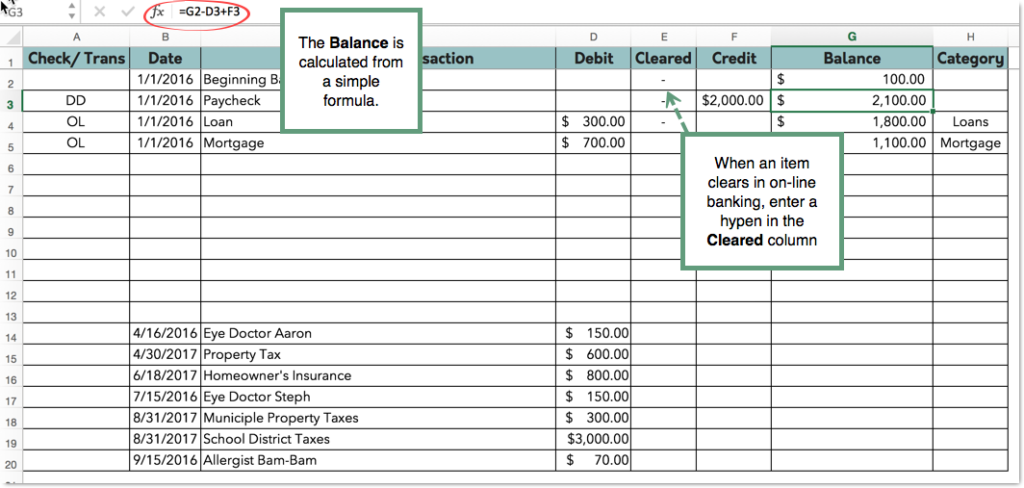

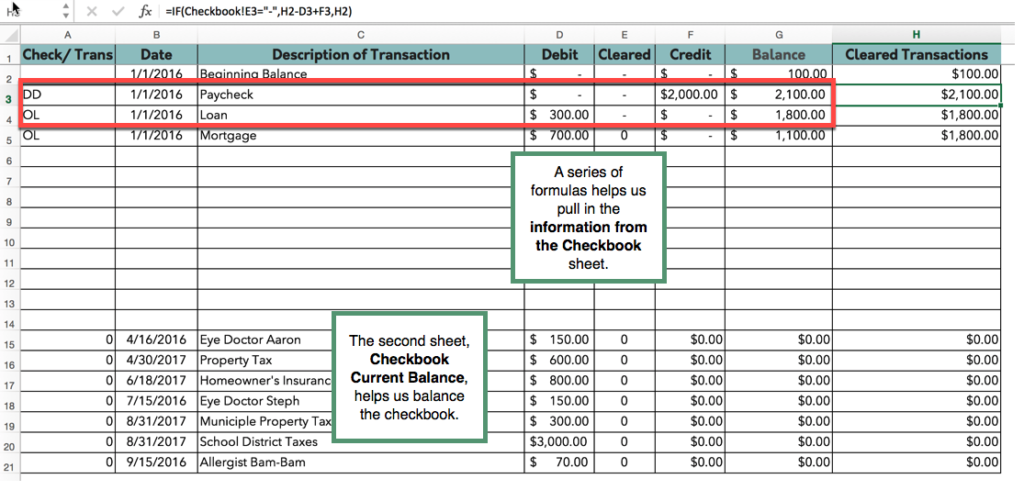

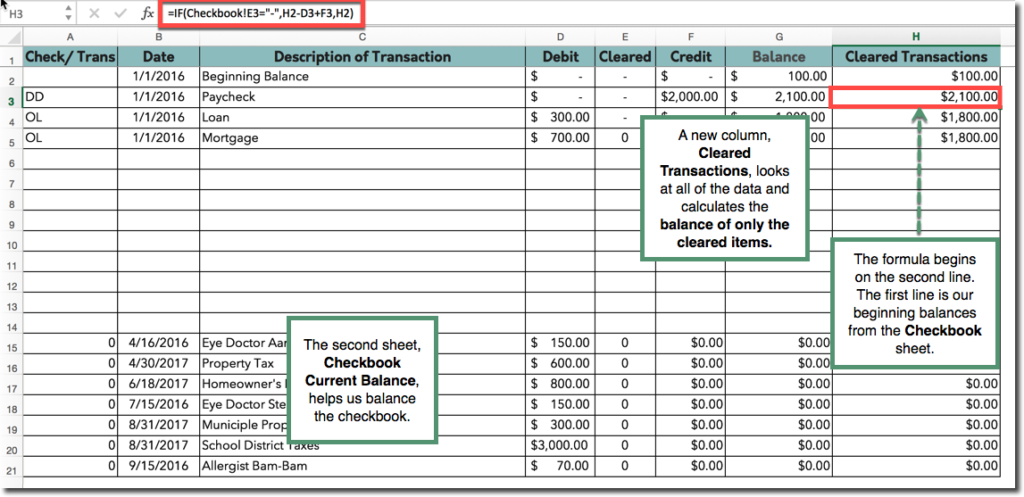

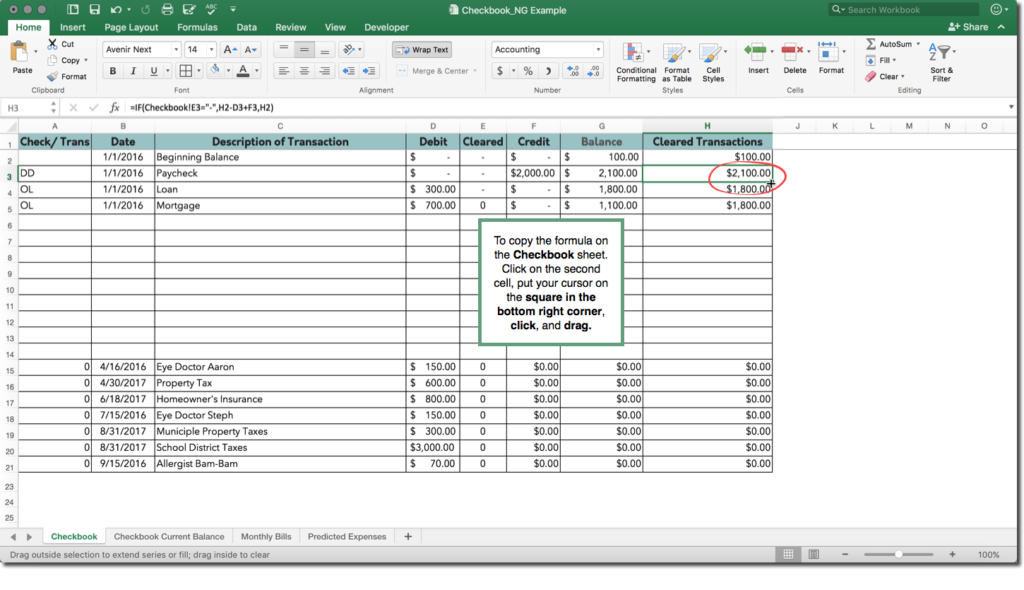

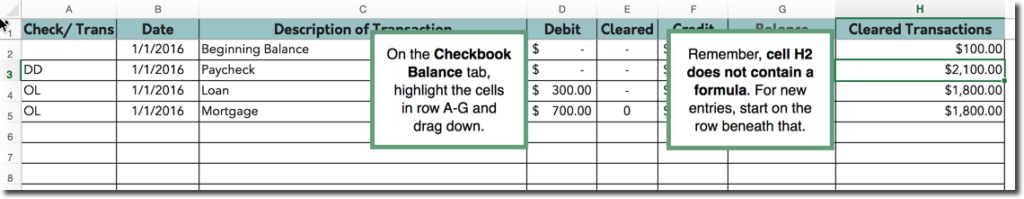

We decided to go old. Well, relatively old school, anyway. Instead of paying for an app or wrecking out credit, we created a checkbook in Microsoft Excel. It’s the opposite of my complaint list above and it’s FREE. Here’s how it works.

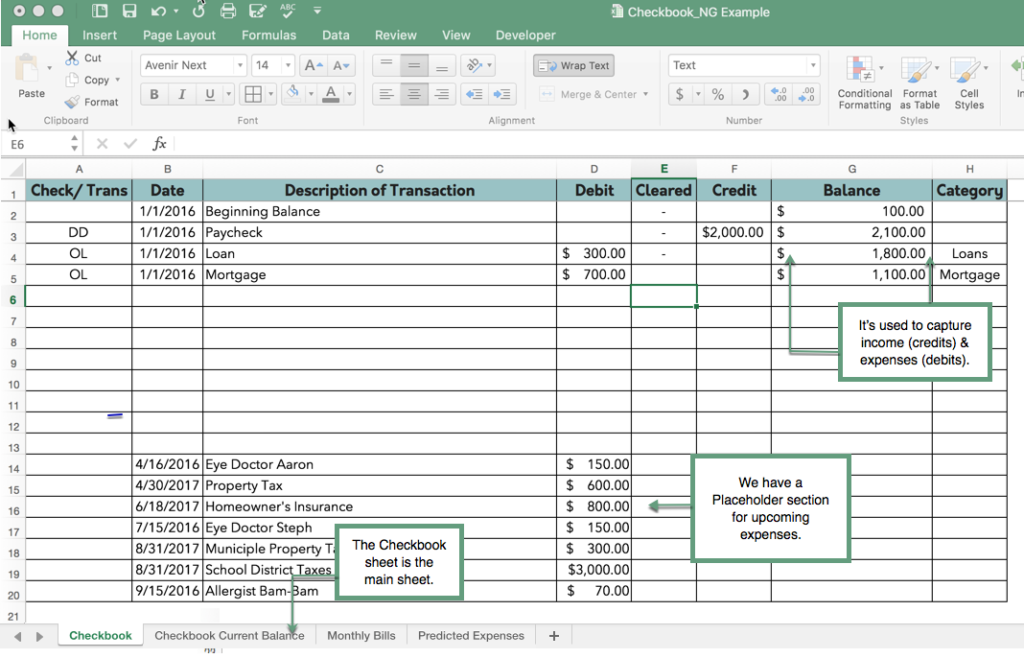

The two main sheets are Checkbook and Checkbook Current Balance. The Checkbook sheet captures our entries. It also contains a Placeholder section to plan for future expenses. Click on any of the images below to enlarge them.

Other worksheets also include:

- Upcoming Expenses

- Monthly Expenses

Curious? Click below to download your FREE copy!

[wpfilebase tag=file id=35 /]

Other Tools We Love

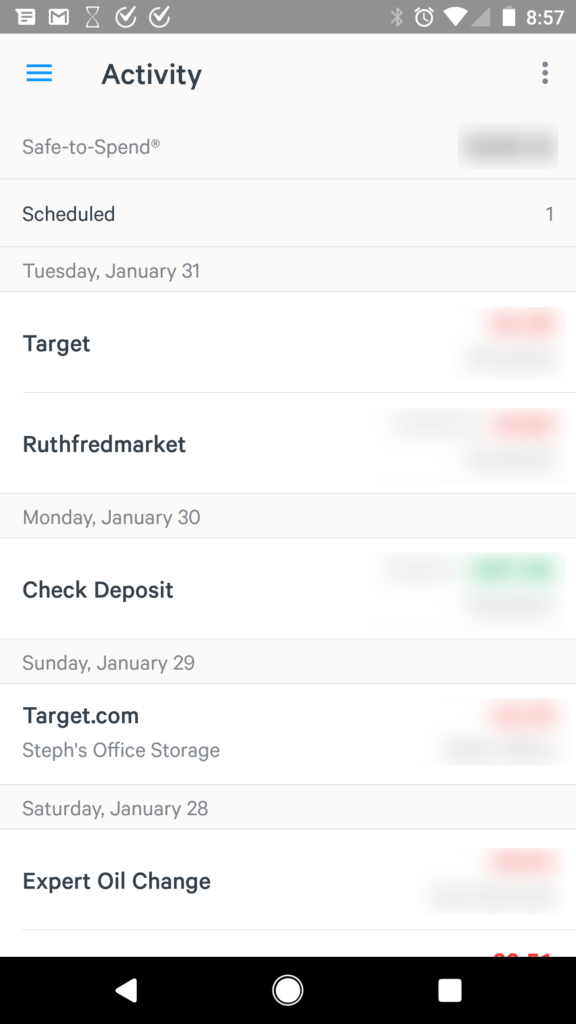

Simple

We found Simple when searching for a low or no-fee bank. This bank has oodles of potential. Though, they aren’t really a bank exactly. They are kind of like a front end for a bank. Their money management tools, which include the ability to set money aside without “moving it”, easy bill pay, and notifications when an expense is incurred, are fabulous.

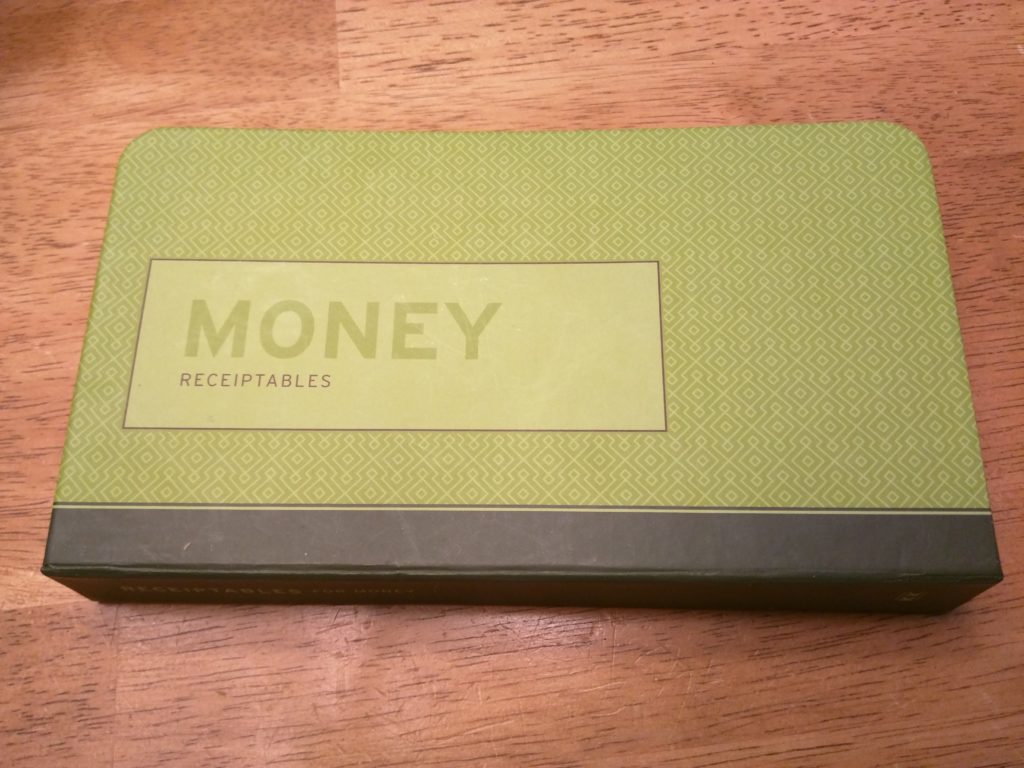

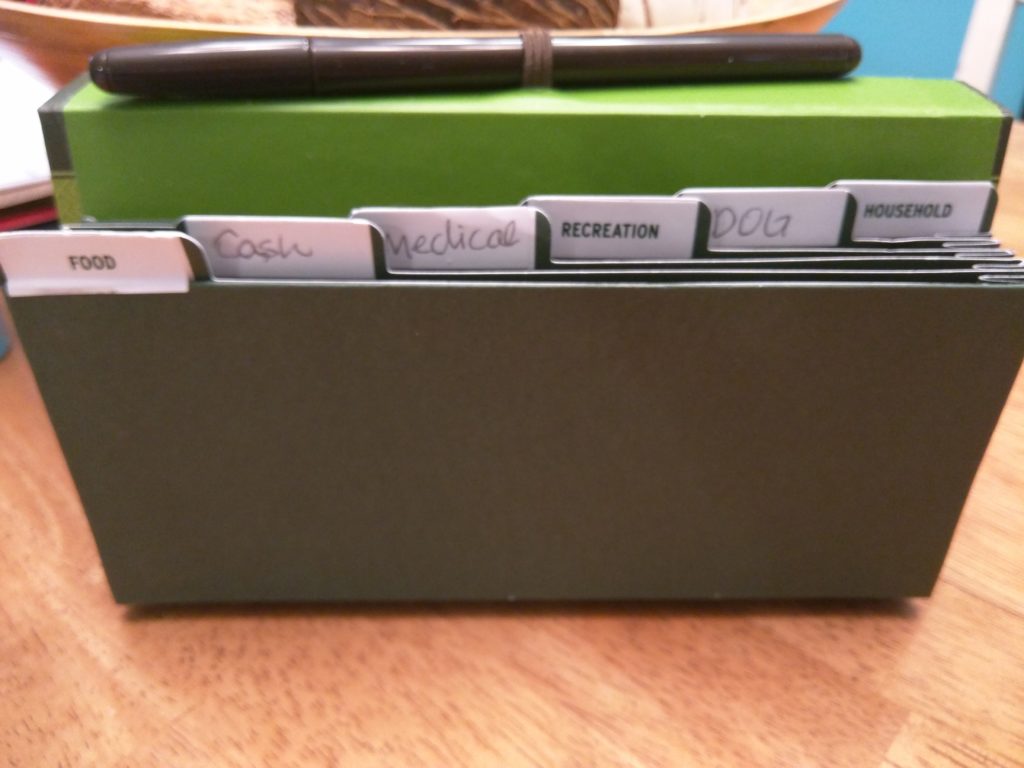

Cash Organizer

Though we can’t balance the checkbook every month like Mom did, we can use case more. The Personal Banker Organizer is a great way to keep track of that green!

Summary

Don’t relive your financial disasters every day. Skip the Groundhog Day cycle!

We’ve been using our spreadsheet checkbook system for 15 years now. We also have a weekly meeting review it, so we don’t forget anything. What are your tips and tricks for keeping your money inline? Share in the comments below!

Questions? Email us: nerd@thenerdgarden.com.

2 thoughts on “Has Your Financial Life Turned Into Groundhog Day?”

Thank you this is great Intel, and real life info.

Thanks Earnest! So glad you found it helpful! ?

Comments are closed.